Asia Pacific Electric Vehicle Market Charging Ahead: A USD 273.17 Billion Opportunity by 2030

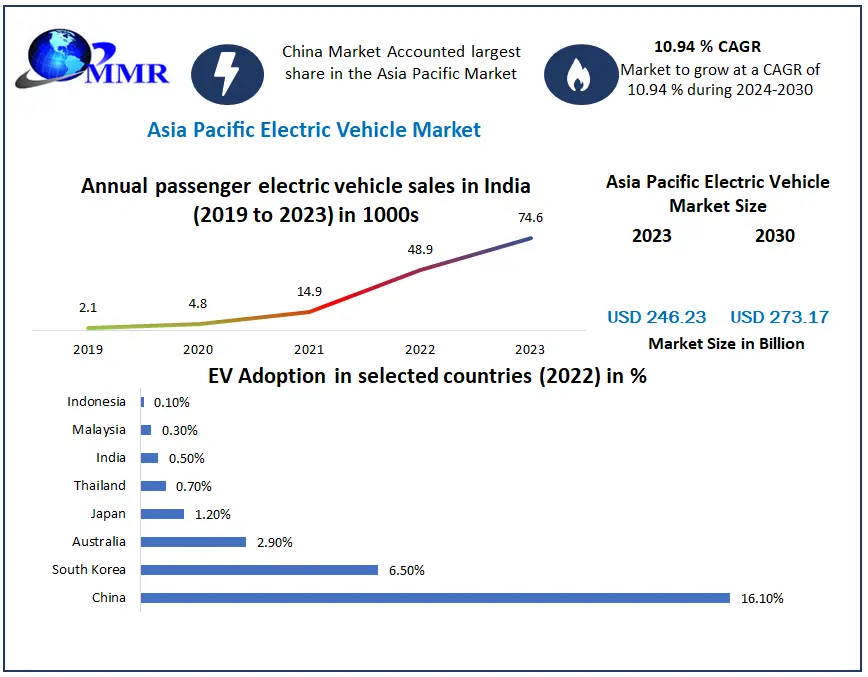

The Asia Pacific Electric Vehicle (EV) Market, valued at USD 246.23 billion in 2023, is accelerating rapidly and is projected to reach USD 273.17 billion by 2030, growing at a CAGR of 10.94% during the forecast period. This surge reflects the region’s strategic push toward clean transportation, green energy innovation, and sustainability.

Market Overview: Transitioning to an Electric Future

Electric vehicles are reshaping the automotive industry. Unlike internal combustion engine (ICE) vehicles, EVs are powered by electricity stored in rechargeable batteries. These vehicles not only reduce carbon emissions but also offer lower operational costs and quieter operation, making them a vital component of national decarbonization strategies.

Across the Asia Pacific region, governments, industries, and consumers are aligning toward an electric mobility future. China, India, Japan, South Korea, and Southeast Asian nations are collectively implementing aggressive EV policies, developing local manufacturing capacities, and investing in EV infrastructure.

Unlock key market insights by accessing the sample report through the link .@https://www.maximizemarketresearch.com/request-sample/1743/

Key Market Dynamics

1. Government Incentives Driving Mass EV Adoption

Asia Pacific governments are offering a comprehensive array of incentives to catalyze EV adoption:

-

Subsidies and tax benefits for EV buyers and manufacturers

-

Exemptions from registration fees, tolls, and licensing lotteries

-

Investments in EV charging infrastructure (EVCI)

-

National targets for ICE phase-out and EV production quotas

For instance, China remains the world's largest EV market, both in production and consumption, backed by robust policy support. India, meanwhile, is aggressively pursuing EV transformation to reduce oil imports and urban air pollution.

2. Technological Progress and Local Resource Advantage

Battery innovation, especially in lithium-ion and nickel-based chemistry, is a major enabler of market growth. Countries like Indonesia, with the world’s largest nickel reserves, are leveraging their mineral wealth to create domestic battery manufacturing hubs.

EV costs are falling due to technology advancements and economies of scale. This is helping bridge the gap between EVs and conventional vehicles in terms of affordability.

3. Two- and Three-Wheelers Fueling Affordability and Adoption

The Asia Pacific market is characterized by its dominance in electric two-wheelers (motorcycles, scooters) and three-wheelers (rickshaws, tuk-tuks). These segments account for over 90% of EV sales in countries like India, where affordability, short-distance travel, and government support converge to drive adoption.

India’s EV two-wheeler market has become a global focal point, supported by schemes like FAME II, state-level subsidies, and rising fuel prices.

Market Challenges

Despite promising growth, several hurdles remain:

1. High Initial Purchase Cost

Although EVs are cheaper to operate, the upfront purchase price—especially of four-wheelers and commercial EVs—remains relatively high due to expensive battery components.

2. Charging Infrastructure Deficit

The lack of a widespread and interoperable charging network, particularly in rural and semi-urban areas, discourages long-distance EV travel and contributes to range anxiety.

3. Environmental and Supply Chain Concerns

Battery production involves environmentally intensive mining processes. Moreover, safe battery disposal and recycling are critical challenges for long-term sustainability.

4. Strain on Power Grids

Widespread EV adoption will put added pressure on regional electricity grids, especially during peak charging hours. Infrastructure upgrades are vital to accommodate rising demand.

Segmentation Analysis

By Vehicle Type:

-

Two-Wheelers: Represent the largest volume segment. Ideal for urban commutes and rapidly growing in South Asia and Southeast Asia.

-

Passenger Vehicles: Gaining momentum, especially in China and Japan. Includes sedans, hatchbacks, and SUVs.

-

Commercial Vehicles: Dominated the market in 2023. Includes electric vans, trucks, and buses used for cargo transport, public transit, and fleet operations. The cost-efficiency for high-mileage fleets is a key driver.

-

Others: Encompasses special-purpose EVs such as delivery robots and low-speed neighborhood vehicles.

By Propulsion Type:

-

Battery Electric Vehicles (BEVs): Dominant segment in 2023. BEVs run solely on electric batteries and emit no tailpipe emissions.

-

Plug-in Hybrid Electric Vehicles (PHEVs): Combine ICE with battery power. Gaining traction in regions where full electric infrastructure is still developing.

-

Hybrid Electric Vehicles (HEVs): Use a mix of electric and petrol/diesel engines but cannot be charged externally.

-

Others: Include fuel cell electric vehicles (FCEVs) and low-speed electric vehicles.

Gain Valuable Market Insights by Exploring the Sample Report :https://www.maximizemarketresearch.com/request-sample/1743/

Regional Insights

China: Global Epicenter of EV Manufacturing

In 2022, China produced 60% of the world's EVs and continues to dominate in 2023, with over 90 local brands offering models across a wide price spectrum. The average EV cost in China is significantly lower than in Europe, accelerating mass-market adoption. Although Europe voices concerns over China’s export subsidies, Chinese EVs are expected to make up 20% of EU EV sales by 2030.

India: Fastest-Growing EV Hub

India saw a 168% YoY increase in EV sales in 2021, with significant growth continuing. Over 50% of new three-wheelers sold in 2022 were electric. Local players like Tata Motors, Mahindra Electric, and startups are capitalizing on federal support, high fuel prices, and rising consumer awareness.

Japan and South Korea: Pioneers in Electrification

These countries lead in hybrid adoption and are expanding BEV penetration. Stringent emission regulations, high-tech manufacturing capabilities, and energy security concerns are driving growth.

Southeast Asia: Emerging Potential

Countries like Thailand, Indonesia, and Vietnam are rolling out EV mandates and production targets. Indonesia plans to ban fossil fuel motorcycles by 2040 and cars by 2050. Thailand’s "3030 Policy" targets 30% EV production by 2030.

Recent Developments

-

BYD, a major Chinese EV brand, expanded its presence in Europe and India, launching new models and establishing battery plants.

-

CALB completed its second EV battery production site in Wuhan with a USD 3 billion investment.

-

India’s EV sales continue to triple, with automakers launching affordable models for rural and urban consumers.

Key Market Players

The Asia Pacific Electric Vehicle landscape is shaped by both established automakers and ambitious startups:

-

TATA Motors – Leading India’s EV revolution with affordable urban models.

-

BYD Company Ltd. – China’s top EV producer with global expansion plans.

-

Mahindra Electric – Pioneer in India’s electric mobility space.

-

NIO Inc., XPeng, Li Auto – Innovators in premium EV segments in China.

-

SAIC Motor, Geely, Great Wall Motors – Giants offering mass-market and luxury EVs.

-

Chery, JAC Motors, WM Motor – Rising stars with export ambitions.

-

Suzuki – Investing in hybrid and electric platforms for the Asia market.

Future Outlook

With rising environmental consciousness, national climate goals, and rapid innovation, the Asia Pacific Electric Vehicle Market is on the brink of explosive growth. A convergence of policy support, cost parity with ICE vehicles, localized battery production, and public-private collaborations will determine the region's leadership in the global EV race.

Countries that act quickly to build robust EV ecosystems—spanning charging infrastructure, supply chains, and financing—stand to gain the most. As Asia hosts six of the ten most climate-vulnerable nations, the urgency to electrify transport is not just economic—it’s existential.

Conclusion

The Asia Pacific EV Market is no longer a niche trend—it's a regional movement reshaping transportation, trade, and energy strategies. With forward-thinking policy, expanding consumer adoption, and technological leadership, the region is paving the road for a sustainable electric future.

Comments on “Asia Pacific Electric Vehicle Market Outlook: Charging Toward a Sustainable Future 2030”